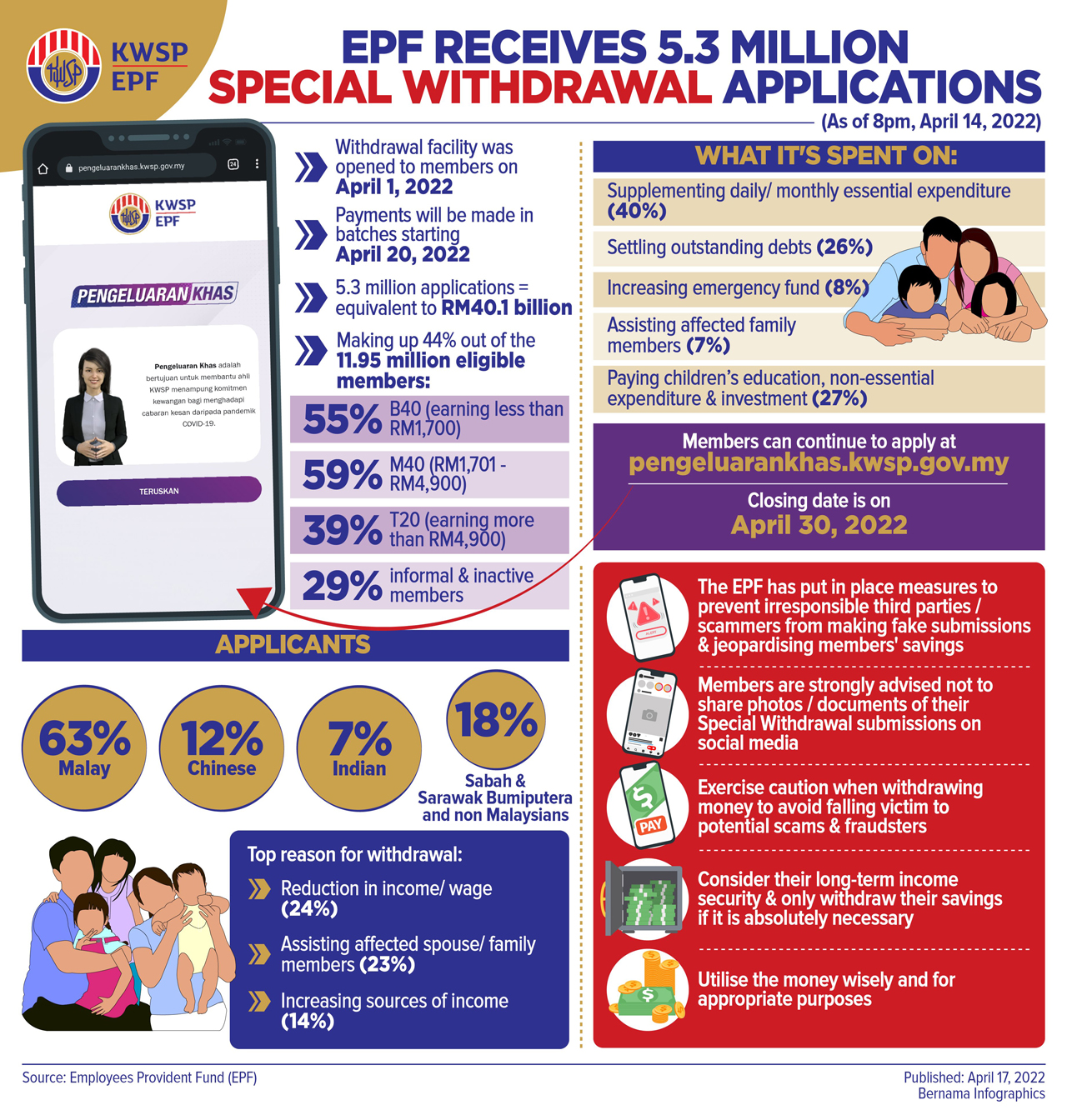

1065 Views Asked 11 Years Ago. This initiative is expected to benefit approximately 12 million EPF members with an estimated total.

Register Ba Hons Graphic Design 60126544232 Wapps Or Gpergaminelli Gmail Com Rm 24870 4 Years 12 Semesters On Campus Online Or Online 100 Mqa A

Can We Withdraw Money From Kwsp.

. They should ensure fully utilised savings balances in Account 2 before proceeding to the first tier. Answered on Sep 7. Who Can Apply Requirements.

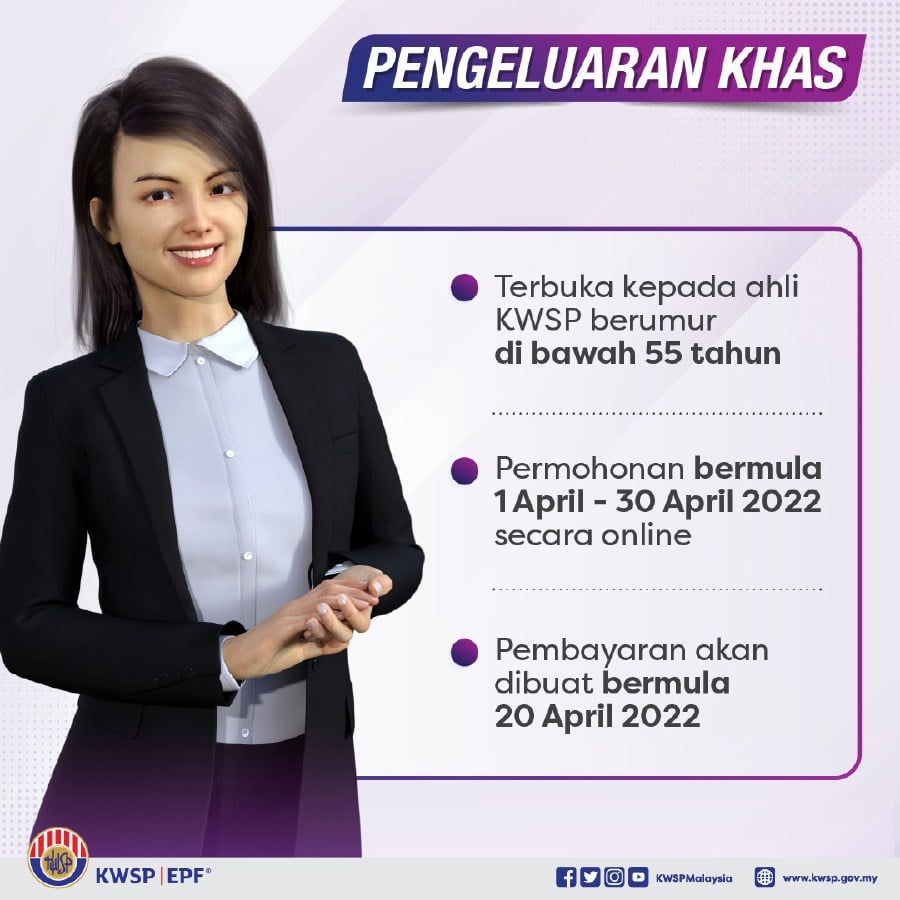

Applications for the special withdrawal will be open to members under the age of 55 starting 1 April and ending at the end of next month. May 4 2020 1000 AM updated 2y ago. Withdrawal from Account 2 to.

Age 55 Years Investment Application can be made anytime. May 4 2020 1001 AM. This is the most common form of EPF withdrawal.

Sijil Kewarganegaraan dan lain-lain dokumen pengenalan untuk bekas warganegara yang menjadi ahli KWSP sebelum 1 Ogos 1995 dan tidak dapat menunjukkan kad. Age 50 withdrawal. I thought 55 and 60 so age 50 can witraw which account.

Withdraw RM20000 RM10000 and RM50 in total. Withdraw EPF to BSN account and then quickly transfer to your kids account to keep cash. The retirement fund said the services are available at branches in states that are implementing the Conditional Movement Control Order CMCO guidelines as.

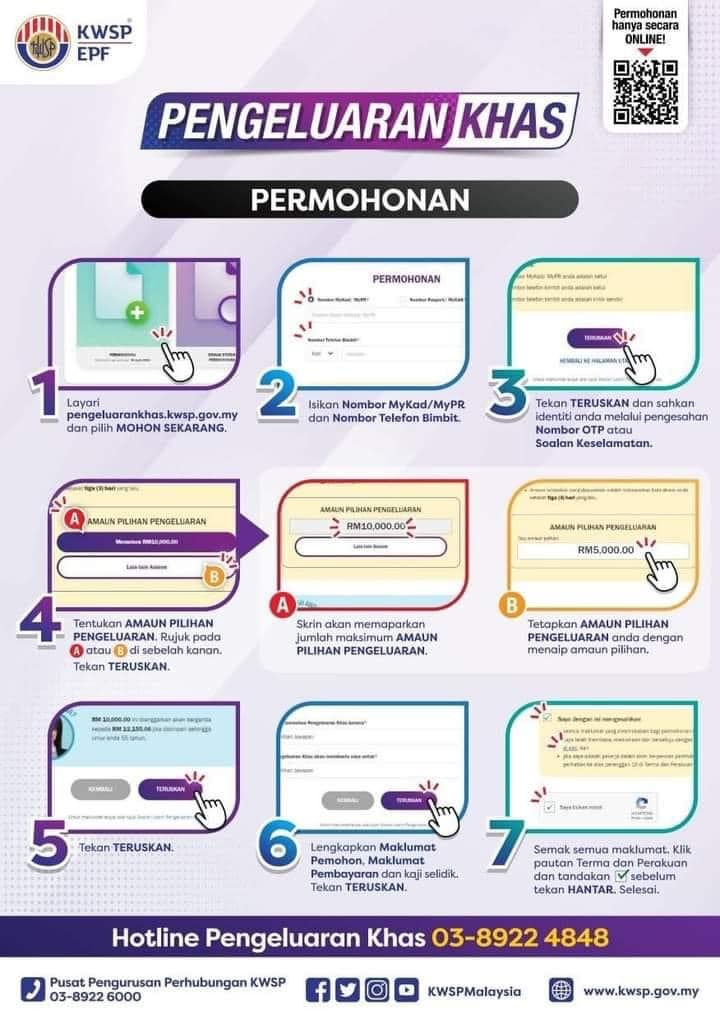

Asked on Sep 7 2010 at 2115 by. Registered onafter 1 Aug 1998. Members of the Employees Provident Fund EPF who are below the age of 55 can apply to withdraw their savings in the fund from 1 April to 30 April 2022.

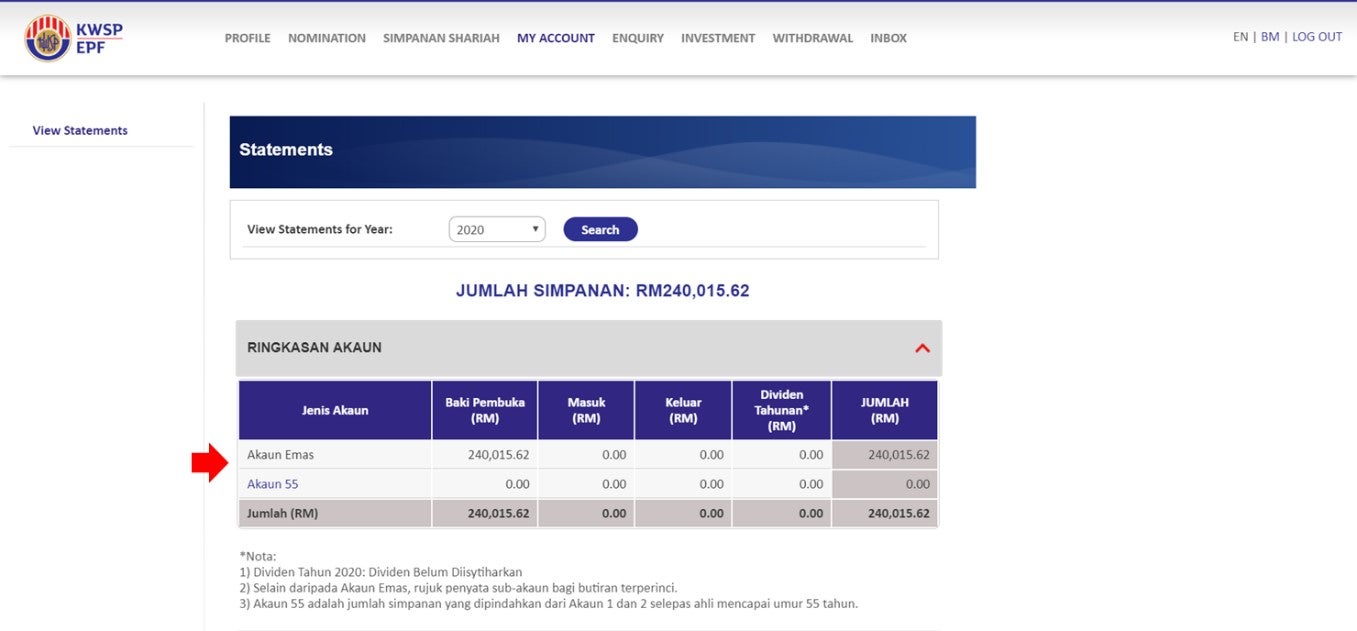

The EPF gives members with more than RM1 million in savings the flexibility to withdraw and manage excess savings on your own. EPF members are allowed to withdraw a maximum amount of RM10000 and a minimum of RM50. EPF withdrawal at age 50.

90 of the EPF balance can be withdrawn after the age of 54 years. 0 found this helpful. Withdraw via i-Akaun plan ahead for your retirement.

Withdrawal from Account 2. This form-free application is only applicable for the following withdrawals. 8 rows Accumulated contributions can only be withdrawn at age 60.

Have savings of more than RM1 million with the EPF. The EPF said in a statement that the payment period will start on 20 April 2022. The retirement fund said the services can be done at branches located within states that are implementing the conditional movement.

For EPF members that are interested to withdraw you can apply to start from 1st April 2020. Additional forms documents required. The EPF stated that members can only apply for the withdrawal once and the amount that can be withdrawn is.

To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. For certain withdrawals we at the EPF have enabled Hassle Free Applications for MyKad holders which they can withdraw at any EPF Counters without the need for forms. A member can withdraw the full amount from their Akaun 2 when they turn 50.

Get Free Credit Report with Complete Analysis of Credit Score Check Now. You can make a one-time withdrawal of all or part of your savings in EPF Account 2 when you reach age 50. Nevertheless it is encouraged that members do not withdraw their savings in Akaun 2 at age 50 because once they withdraw it entirely its gone and they do not earn their annual dividends.

Epf age 50 can witraw saw at the lyn banner this morning Chat views SUS pundi. Eligible members can withdraw up to RM500month from Account 2 for a period of 12 months. This is only applicable to EPF members aged below 55 years old.

You have the option to withdraw EPF savings at age 50 or 55 either partially or fully or at age 60 when you can then withdraw any amount at any time. Age 50 55 and 60 or More Than RM1 Million Savings. What You Can Withdraw Any Amount.

When you reach a certain age the EPF allows you to withdraw partially or in full the savings in Account 2. In the case of a withdrawal at age 50 or 55 partially or fully or at age 60 you can withdraw as much as you like. KUALA LUMPUR May 4 The Employees Provident Fund EPF will be resuming Age 505560 Withdrawals and mobile i-Akaun activation services beginning Wednesday May 6 at approved branches throughout the country.

KWSP 9C AHL D5 Buy or Build Home. I will be 50 soon. Minimum withdrawal is RM600 RM100 per month for at least 6 months The minimum payment period is 6 months and maximum up to 12 months Registered before 1 Aug 1998.

The 15 different categories of withdrawals have been divided into Account 1 only Account 2 only both accounts withdrawals. Details on Malaysias EPF KWSP Account 1 VS Account 2 withdrawals. THE Employees Provident Fund EPF will be resuming Age 505560 Withdrawals and mobile i-Akaun activation services from Wednesday May 6 at approved branches throughout the country.

Below 55 years of age. Further details will be announced by the EPF on its website or social media platform. The Employees Provident Fund EPF will.

Minimum transferred amount is RM 100000. After leaving a job a person can withdraw 75 of the provident fund balance if he remains unemployed for 1 month and the remaining 25 after the second month of unemployment. Information is for general reference only is an unofficial summary based on EPFs official website.

Epf The Withdrawal Syndrome The Star

Kwsp Epf Partial Withdrawal Age 50

Malaysian Employees Below The Age Of 55 Can Withdraw Funds From Epf Through I Citra

Epf Special Withdrawal Payment From April 20 Onwards

Additional Epf Withdrawals Can Cause Retirement Below Poverty Line Says Finance Minister The Star

General Information Epf I Invest Via I Akaun Principal Asset Management

I Citra Epf Says No Provision In Employees Provident Fund Act That Allows Withdrawals Under Natural Disasters Natural Disasters Disaster Response Disasters

Epf Special Rm10 000 Withdrawal What To Know Before Applying

The Rundown On Epf Withdrawals

Rm10 000 Epf Withdrawal Now Will See Greater Financial Loss News Mysinchew 星洲网 Sin Chew Daily Malaysia Latest News And Headlines

Epf Special Rm10 000 Withdrawal What To Know Before Applying